Want a way to beat the majority of investment professionals? Want to do it in a low stress and very easy to implement manner? Then one strategy to consider is a classic three fund portfolio. Read on to learn more about this effective investment solution.

Investing is Hard – Or So They Say

Investment professionals – aka salespeople – want you to believe that investing is hard. They are very motivated to convince you that you should not invest on your own. Here are a few of the most common arguments they give to convince you to hand over your money to them:

- To be successful, you need to know exactly what investment products to buy. They have access to those products.

- You need to be able to read the market and adjust based on what it is doing. They know when to do this.

- You don’t have the required training and education to invest properly. Just as you use a lawyer for legal advice, you should use an investment expert for investing advice.

- You don’t have the time to properly monitor your investments. Spend time on what you want to do, and leave the investment management to them.

Why do they tell you this? Simply because they make money by managing your money for you. They earn fees either as a percentage of your overall portfolio, or by selling investment products to you. They are motivated to make things seem hard so that you are convinced that they are earning their high fees.

The trouble is that these investment professionals have poor investment performance and their high fees have a negative impact on investment returns. The good thing is that there is a very easy to implement solution that a do-it-yourself investor can use.

Before getting into this easy solution – the Three Fund Portfolio – let’s have a look at this poor performance and the impact of high fees on investing.

Most Investment Pros Can’t Beat the Market

The challenge with turning your money over to investment professionals, no matter what they say, is that they struggle to even get the market returns. In simple terms: you are paying fees to earn less money than the market is giving.

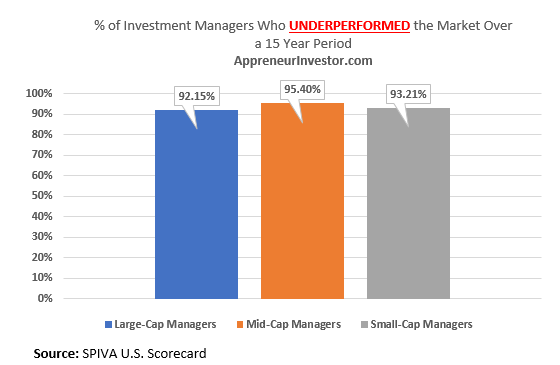

One of the best sources of investment management performance is the SPIVA U.S. Scorecard done by S&P Global. In their 2016 report, they provide the following data:

It is clear to see that the overwhelming majority of investment money managers underperform the market. To warrant their fees (see below), you should expect to see performance much greater than the market. That is obviously not the case based on this data.

Impact of High Fees on Investment Wealth

A second reason that complicated investment strategies, products, and high fee investment advice should be avoided is due to fee drag. For every dollar your portfolio pays in fees, that is one less dollar that you have to spend in retirement.

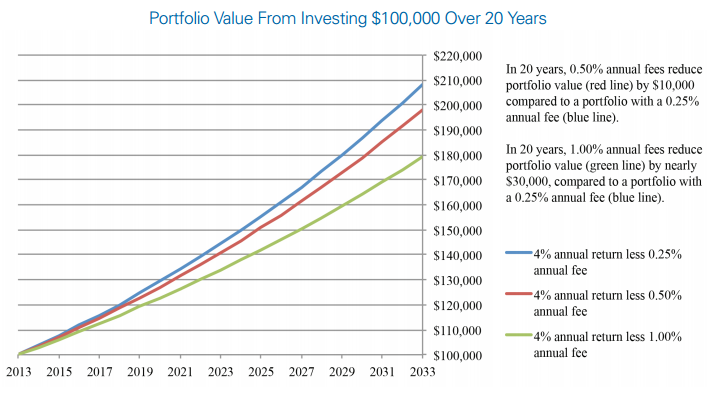

Here is a chart from the Securities & Exchange Commission that shows the huge effect high management fees have on investing value.

What seems like a modest fee of 1.00% reduces the ending value of a $100,000 investment by over $30,000 when compared to a 0.25% management fee. It is not hard to image in the impact that fees in the range of 2 – 3% – which are common in the investment management space – can have on portfolio value.

That is money that is wasted when there are other alternatives to get better performance at lower fees.

The Hack: A Three Fund Portfolio

If investment professional charge high fees for poor performance, then what are the alternatives? One of the most common, and easy to implement is the Three Fund Portfolio.

What is the Three Fund Portfolio

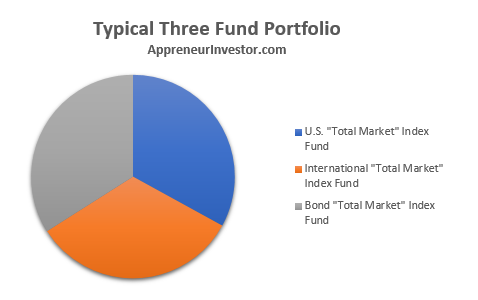

There are few different versions of the Three Fund Portfolio, however at its core it is built using three different, very low cost index funds or ETFs. The combination of these three funds create a diversified but simple portfolio that is very easy to put together and monitor over time.

The portfolio is put together using a U.S. “total market” index fund, an international “total market” index fund, and a bond “total market” index fund.

Benefits of the Three Fund Portfolio

There are few key benefits that you gain by using the Three Fund Portfolio. Let’s have a look at two of the most important ones for you to consider:

Diversification

The main benefit of the three fund portfolio is that it provides a high degree of diversification. By investing in “total market” index funds, you are essentially buying the whole market for U.S. equities, international equities, and bonds. You have little chance of making a mistake by buying the wrong investment, since you essentially own them all

International Exposure

Related to diversification, but important to call out on its own, the three fund portfolio gives you international exposure. Most investors suffer from “home country bias” which gives them too much exposure to investments in the country they live in.

However, since the stock markets around the world can perform better or worse at different times, it is a good idea to invest more broadly. For example, if the U.S. markets suffer, there may be other markets in the world that do much better. Having access to the international markets helps to balance this risk and provide opportunity for better performance.

Low Fees

A third very important benefit is that the Three Fund Portfolio can be built with very low fees. For example, a Three Fund Portfolio built using Vanguard funds has fees of only 0.08%. If you go with another alternative, like BlackRock iShares, the fees are slightly higher at 0.19%. Compared to average management fees of 2 – 3%, those low fees will have a massive impact on the end value of your portfolio when you are ready to retire.

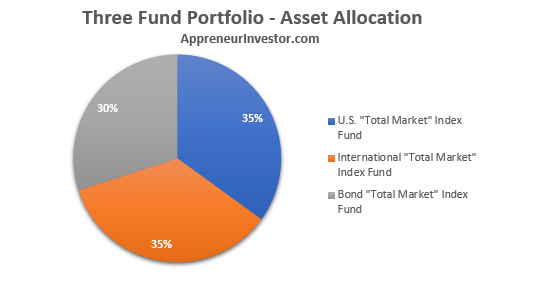

What Percentage Goes into Each of the Three Funds

If you decide to use the Three Fund Portfolio, your next task is to determine what percentage of your money to invest in each of the three funds. This is usually referred to as your asset allocation.

The simplest method is to split your money and buy equal amounts of each of the three funds. That means that your portfolio will have approximately 33% of your investment dollars going to each fund.

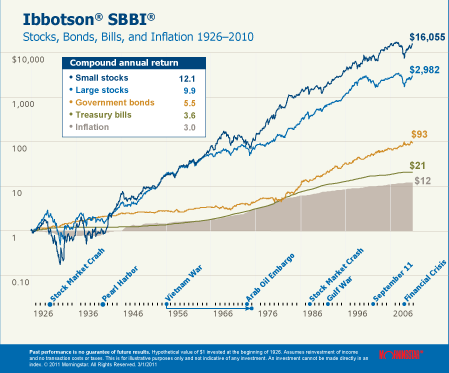

Alternatively, another suggestion is to determine what percentage of your investments you want to put into equities and invest the remaining amount in the total market bond fund. This method of asset allocation selection is often done to put more money into equities when you are further away from retirement. Essentially, you can put more money at risk the longer you have until you need the money. This higher exposure to equities has usually provided better returns as stocks have done much better over the long term. This chart shows the data for the out performance of stocks versus bonds.

To use this method, you take 100 minus your age and that is the percentage you put into the equities portion (U.S. and international). For example, if you are 30 years old then you would invest 70% equally into both the U.S. and International funds (35% of your money into each fund) and the rest (30%) into the bond fund. Your Three Fund Portfolio would look like this:

What Index Funds to Buy

The final task is to determine what three index funds to buy. The most important factors with this step is to choose funds that provide access to the “total market”. A lot of index funds only buy the S&P 500 or a selection of international assets. Total market funds do exactly what they say; they buy the total market meaning you are getting exposure to the whole universe of stocks and bonds.

Here are the most common, and cheapest, options for you to consider:

- Vanguard: U.S. Total Stock Market ETF (VTI), Vanguard Total International Stock Index Fund (VXUS), and Vanguard Total Bond Market ETF (BND).

- Charles Schwab: US Broad Market ETF (SCHB), International Equity Index ETF (SCHF), U. S. Aggregate Bond Index ETF (SCHZ)

- BlackRock iShares: iShares Core S&P Total Market ETF (ITOT), iShares Core MSCI Total International Stock ETF (IXUS), iShares Core Total U.S. Bond Market ETF (AGG)

Conclusion

There are a lot of ways to invest your money to make it grow. If you listen to investment advisors or mutual fund sales people then they will tell you that it is hard to do. Just as you get legal advice from a lawyer, you should only rely on investment advice from a licensed investment advisor.

There are a lot of ways to invest your money to make it grow. If you listen to investment advisors or mutual fund sales people then they will tell you that it is hard to do. Just as you get legal advice from a lawyer, you should only rely on investment advice from a licensed investment advisor.

The reality is that most investment advisors fail to get market returns and charge high fees in the process.

An alternative, and proven strategy, is the three fund portfolio where you invest in the U.S. total stock market, the International total stock market, and the total bond market. When built using funds from Vanguard or Schwab, this portfolio provides you with solid diversification at very low cost.

Do you invest in index funds or do you use a financial advisor? If you invest in index funds, did you start out with a financial advisor before making the switch? What’s your favorite lazy portfolio?