How to Save Over $200,000 A Year Pre-Tax with 401K and Cash Balance Plan Contribution Limits

As of 2017, the 401K caps your personal contribution at $18,000. Your company can then match up to $36,000 profit sharing contribution to bring you to the total $54,000. If you’re an entrepreneur and own your own company, you can do this yourself to hit that $54,000 maximum every year. However, high income earners and entrepreneurs who are killing it will need to save more. Taxes will hit hard. It sucks that having a successful business penalizes you for doing well by hitting your wallet. I’ll talk about how I saved over $200,000 by combining my 401K with higher cash balance plan contribution limits.

Maximize Your Defined Contribution Limit First

Before going into how to exceed $54,000 maximum contributions using cash balance plan contribution limits, you need to hit $54,000 first. For married couples, double it and hit at least $108,000. I won’t go into backdoor roths, since I’m assuming you are a business owner if you are interested in cash balance plans. Talk to a 401k administrator and get setup. They will help you with your tax forms (5500) at the end of the year.

401K personal contribution limit is $18,000, but your limit across all of your retirement accounts is $54,000.

Let’s look at an example for a business that makes $250,000/year and taxed at the 33% tax bracket. Maximizing your defined contribution limit will lower your effective tax rate down to $142,000. The tax rate is now 25%. That’s an extra $47,000 in your pocket from just setting up this plan! The best way to turbo-boost your way to an earlier retirement.

Before: $250,000 taxed at 33% for $82,500. After: $142,000 taxed at 25% for $35,500. That’s $47,000 in savings.

Turbo Boosting Your Way to Early Retirement

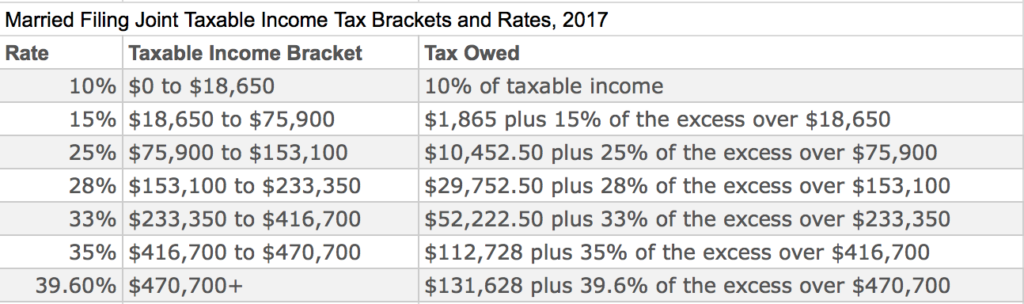

You can do your own calculations to see which tax bracket you are in and how much you can save. Here’s a chart that shows the different income tax brackets and rates for married couples filing joint in 2017. Maximizing your defined contribution limit using your spouse for $108,000 can easily bring you down at least one income tax bracket. This is what high income earners do to avoid tax and build their wealth. Wish I knew this when I first started doing apps. I learned about the $18,000 maximum, but had no idea about maximizing my defined contribution limit to $54,000. Losing a good 2 years of these potential savings was a painful lesson learned. On the bright side, I got married and doubled these contribution limits.

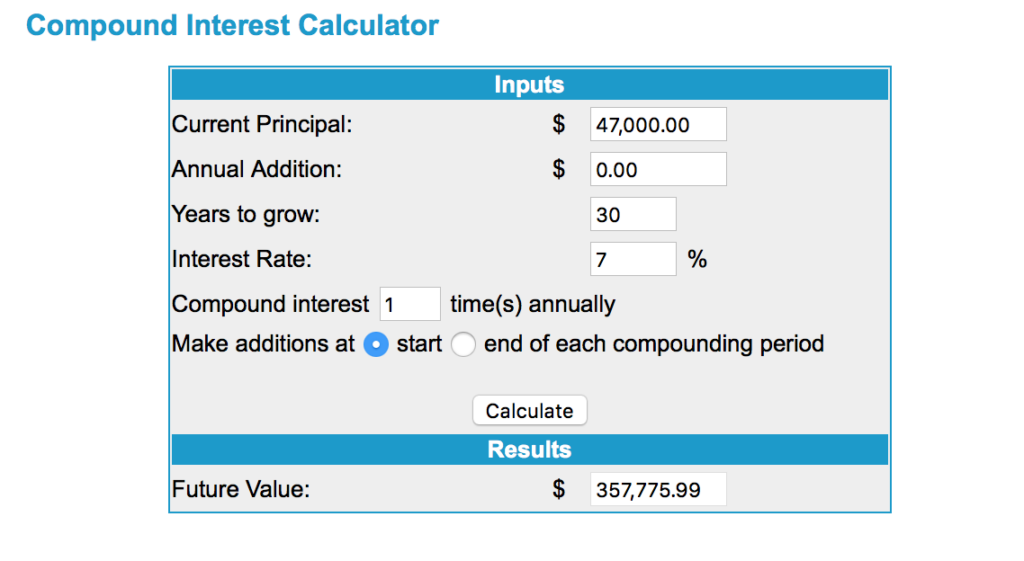

Maximize your defined contribution limit as soon as your can. It will turbo-boost your retirement savings and save you a lot of money that you can invest. In our example, we saved $47,000. Using the compound interest calculator from moneychimp.com, you can see how much $47,000 will grow over the course for 30 years with an interest rate of 7%. Making this change now can potentially increase your future retirement savings by over $350,000.

Adding a Defined Benefit Plan to Exceed $54,000

It’s getting more common and more popular for small business owners to add a defined benefit cash balance plan on top of their 401k plans. Increase your tax savings even more by maximizing your cash balance plan contribution limits. It was 2016 and I was having a killer year. However, I knew I would get hit hard with taxes. The current plan that I had in place wouldn’t be enough, so I looked towards the internet and scoured the forums in search of a better solution. After reading countless blogs and forums on what high income earners do to reduce their taxes, I came across cash balance plans. I immediately searched for a few cash balance plan administrators and asked more questions.

My Questions and Concerns

- The income of an app business is extremely volatile. Cash balance plans need to have consistent and predictable returns. Am I still a candidate for the plan?

- Answer: Yes. If your business goes bankrupt, then we can close out the plan and your can do a rollover into your retirement accounts.

- Cash balance contributions need to have consistent contributions every single year. What if my business income drops by half the following year and I can’t contribute as much?

- Answer: We can make amendments to the plan and adjust the amount you can contribute.

- All the articles I’ve read only show clients of cash balance plans being over 50 years old. I’m in my mid 30’s. Am I too young?

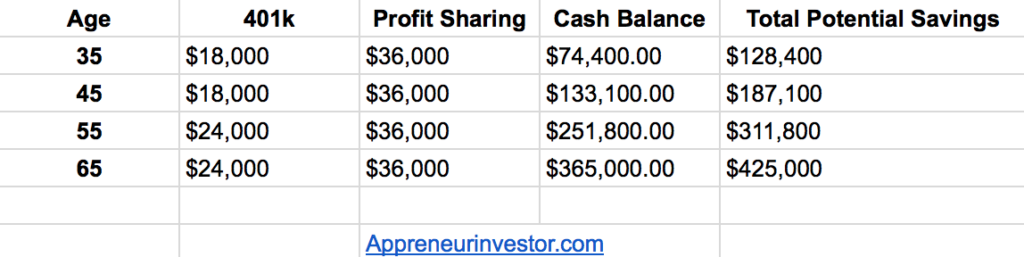

- Answer: No, you are not too young. Allowable contribution amount varies by age. The younger you are, the less you can contribute.

I had a hard time finding answers to those questions when I was Google searching anything and everything related to cash balance plan contribution limits. It wasn’t easy for me to find a lot of information and people who had experience opening these plans.

Cash Balance Plan Contribution Limits

Cash balance plan contribution plan limits are based on age. The close you are to retirement, the more you can save. This has always been the biggest disadvantage for young entrepreneurs and young investors. Performing well early on and having unpredictable income later in age is something we have to work around by taking advantages of the perks. Time is the biggest perk for starting younger. Combine time with saving as much as you can early on and you are well on your way to hit your retirement goals.

These are estimated contribution limits I received based on age. Searching different sites all gave different numbers, but they were all around the same. I’ve always worried that being an appreneur might mean that you peak early and your income in your later years might dwindle. This is the reason I’ve searched everywhere for solutions to help save as much as you can early on. While you are still creating income.

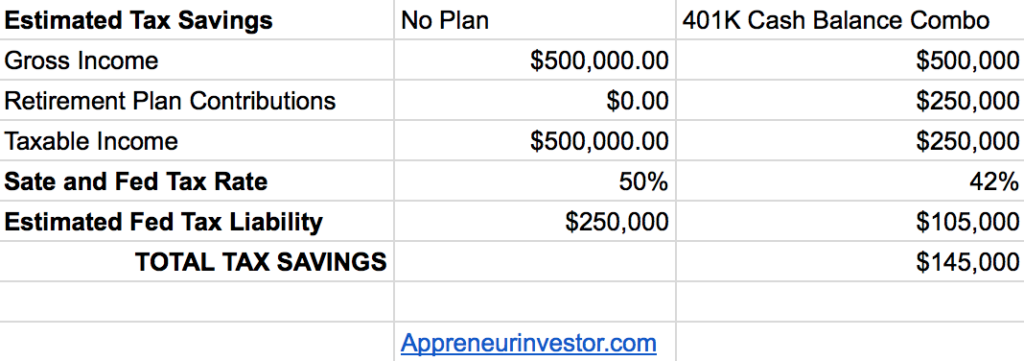

Total tax savings are huge. Having a wildly successful year can leave you worried when tax season comes. Let’s look at an example of earning $500,000 in a year with no plan vs having a 401k and cash balance plan. Contributing $250,000 lowers your taxable income by half and saves you even more tax dollars by putting you at a lower state and fed tax rate of roughly 42%. That’s a total tax savings of $145,000. An extra $145,000 you can invest in a taxable account to reach early retirement faster.

Summary

Get to an early retirement faster by maximizing your total tax savings. Hit the 401k limit of $54,000 and then exceed that contribution amount by adding a cash balance defined benefit plan. This combo will help high income earners by saving more now while you are still making money. Prepare for the unpredictable years ahead. The future you will thank you. You never know what might happen. Hope for the best and ride out your wave of success, but prepare for the worst. Good luck.

Do you have a cash balance plan? When did you find out about maximizing your tax savings? What are your thoughts? Anything advice