Motif Investing Review 2017

In past posts, I have had a look at robo advisors as an option to automate investing. Another competitor in this space is a company called Motif Investing. Motif takes a different approach to investing and can help you invest based on an investment theme. For example, if you believe that gaming stocks have a strong future, you can buy a basket of them. In addition, this is done for you in a fully automated portfolio. In this Motif Investing Review 2017, I will take a closer look at this competitor in the fintech space.

In past posts, I have had a look at robo advisors as an option to automate investing. Another competitor in this space is a company called Motif Investing. Motif takes a different approach to investing and can help you invest based on an investment theme. For example, if you believe that gaming stocks have a strong future, you can buy a basket of them. In addition, this is done for you in a fully automated portfolio. In this Motif Investing Review 2017, I will take a closer look at this competitor in the fintech space.

The Concept Behind Motif Investing

Investment decisions can be made in two ways. The first is by simply taking a whole market view where you buy index funds that track the entire market. The second way is by investing based on a hypothesis that a stock, industry, or sector will perform well. Motif Investing takes the second approach.

As a customer of Motif Investing, you decide what your hypothesis is and then invest based on that hypothesis. For example, if you believe that social media is going to be a huge driver in our society, you can invest in a basket of 20 – 30 of the best social media stocks. Alternatively, if you want to focus on high dividend stocks then you can invest in a Motif that focuses on only those stocks. Motif Investing makes it easy to invest based on these themes, and does all the transactions for you, at a lower cost than buying all the stock individually.

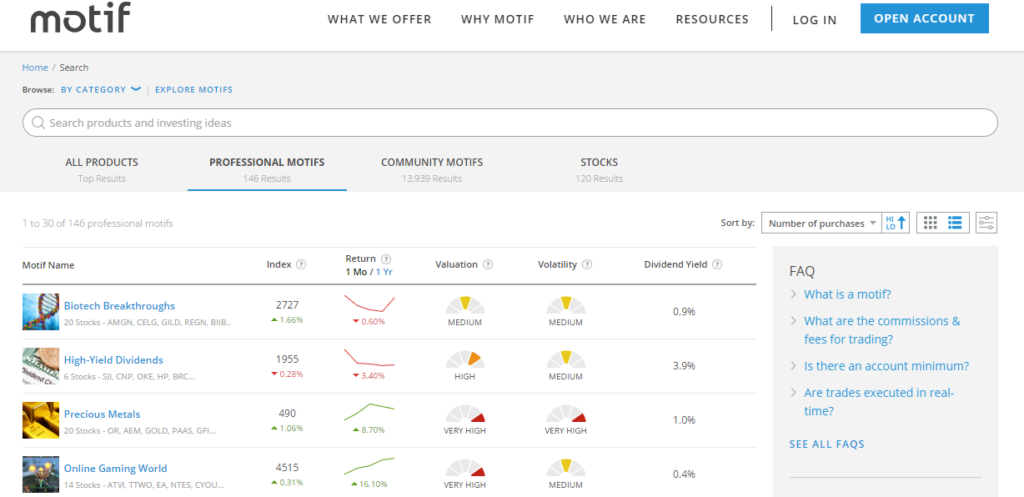

There are a number of themes to choose from, or you can make up your own. A few of the more popular Motifs available include Online Gaming World, Biotech Breakthroughs, High-Dividend Yields, or Higher Highs. You don’t have to choose just one; you can invest in as many Motifs as you want to get good diversification and access to solid growth potential.

If you want more details on what a Motif is an how it works, check out this video:

The Motif Investing Concept – A Unique Approach

Where Motif Investing really shines is how it combines its services to make investing easier. As a customer, the site will offer you the following three things:

- Brokerage services: The ability to buy and sell stocks and ETFs in an easy to use and intuitive platform.

- Portfolio management services: The ability to put together a portfolio based on Motifs that diversify your portfolio and provide opportunity for wealth generation. Keep in mind that you can buy both domestic and global equities and fixed income using Motif Investing so you can build a truly globally diversified portfolio.

- Access to investment ideas: Through performance tracking and users using the various Motifs, you can see which areas of the market have been performing the best and which areas all of Motif’s customer believe will perform well. The site will show you the top selling Motifs that all customers using the service are invested in. This is a great way to test your hypothesis or generate additional investing ideas.

This unique concept Motif Investing has developed – an easy way to invest based on themes – makes it a solid competitor when thinking about how to invest for portfolio growth. Here is a view of a few of the professional Motifs available to customers:

The Two Ways to Use Motif Investing

Originally, Motif Investing only offered its Motif services. The company now has two options for customers, which is the focus for this Motif Investing Review 2017 .

The first is through a trading portfolio that will allow you to buy and sell Motifs or individual stocks on your terms. You can still buy Motifs and have Motif Investing automate that for you. However, in their trading accounts you completely control what you buy and sell. If you simply want to buy all the stocks in the motif, then you can do that. Or, if you want to exclude specific stocks for any reason, you can do that as well. The portfolio you build is completely up to you.

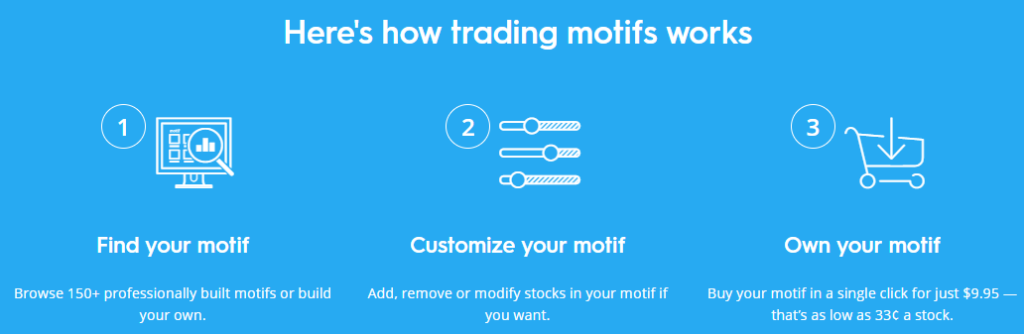

This graphic, taken right from the site, explains how trading motifs work with their trading portfolio service:

The second service offering that Motif Investing provides, and is new for the Motif Investing Review 2017, is the Impact Portfolio. The Impact Portfolio offers full robo-advisor services that invests in five different asset allocations to keep you completely diversified and in an asset allocation based on your stage of life and portfolio needs.

In addition, and this makes their service very unique, is that your portfolio can be aligned to your values. If you desire, you can make sure your portfolio is slanted towards one of three responsible investing methodologies. These values-based themes include “Sustainable Planet”, “Fair Labor”, or “Good Corporate Behavior”.

The Impact Portfolio is available in both non-retirement accounts and retirement accounts including Traditional IRAs, Roth IRAs, and Rollover IRAs.

The Biggest Benefit: Low Fees

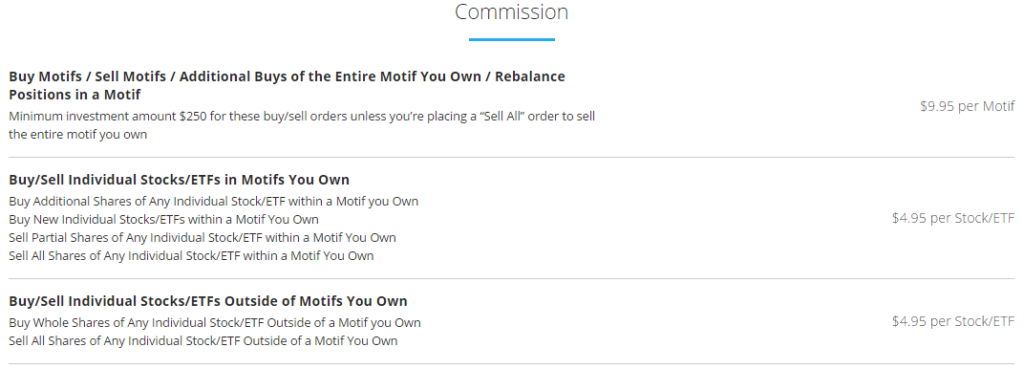

As I have discussed a number of times on this site, investment fees are very important. Therefore, the more you pay, the less you earn. Motif Investing offers a relatively cheap way to get a diversified portfolio. To buy a Motif, which will include anywhere from 20-30 stocks or ETFs, you pay $9.95. That works out to a very low 33 cents per stock or ETF.

If you need to buy or sell just one stock, then the fee is $4.95 per trade, which is a reasonable commission on a per trade basis. This summary table provides a good overview of the fees to complete trades in the trading portfolio.

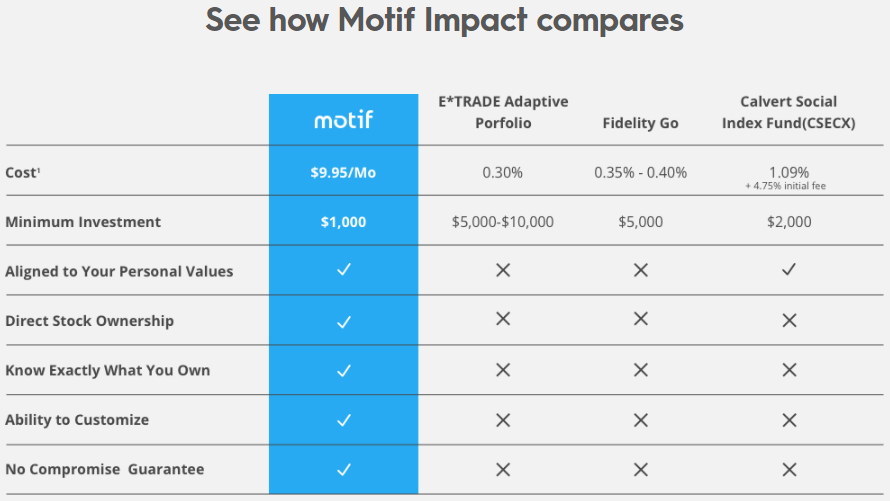

Fees for the Impact Portfolio differ slightly. As you are buying a portfolio, there are no per motif or per stock costs. Instead you pay a flat $9.95 per month up to an $100,000 account size. After that, the fee goes to $9.95 per $100,000 invested. That equates to a management expense ratio of approximately 0.11%, which is pretty good. Included in that fee is automatic rebalancing, the ability to customize, and tax harvesting.

In my experience these fees offer a good value for investors and makes the service worth considering.

Areas for Improvement

As with all investment products, there are some areas for improvement that Motif Investing should consider. The first area for the Motif Investing Review 2017 is the lack of dividend reinvestment. The dividends are credited back into your account as cash and you have to figure our where to invest that cash later. That takes time and cost as you need to complete a stock trade to reinvest that money. Instead, Motif should automatically reinvest those dividends right back into shares of the company or ETF.

The second area for improvement is with the trading account. Investment choices include only stocks and ETFs, and does not include mutual funds or options. This will be a limiting factor for customers who want access to this asset types. However, if you don’t need those investment choices then that is not anything to worry about.

The Bottom Line

Motif Investing offers a unique approach to investing based on themes. With the ability to target segments of the market or investment styles, the automated features of buying a basket of stocks or ETFs is well designed. And with the newly added Motif Impact portfolios, you can get a fully automated robo advisor as well. If you are looking for an option to help diversify your portfolio, then Motif Investing is definitely worth considering.

Have you used Motif Investing before. If so, let us know your experience in the comment section for Motif Investing Review 2017 below.