As an investor, you have a few different levers you can use to improve your chances of achieving financial freedom. One of the most effective ways is to increase your savings rate. If you are a business owner or partner in a company, one tool you may have is a 401k cash balance plan combo.

Your Savings Rate is More Important Than Investment Return

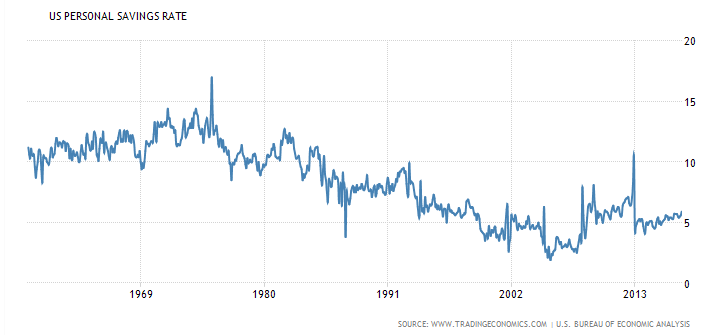

If I were to take a guess, I suspect that when it comes to savings and investing, most of you spend 80% or more of your time thinking about your investment returns. I came to this conclusion because recent research shows that the US personal savings rate is only 5.90%. Have a look at the chart below and you can see the decline since the 1970/1980’s.

That is not a lot of money to be putting aside for retirement. Even though a good return helps, you have no control over what the markets will give you. You could be very unlucky and start investing at the beginning of an expensive market and see low returns (3-4%) for multiple years. Your best course of action is to select a solid portfolio, like a Three Fund Portfolio, and let the portfolio work for you.

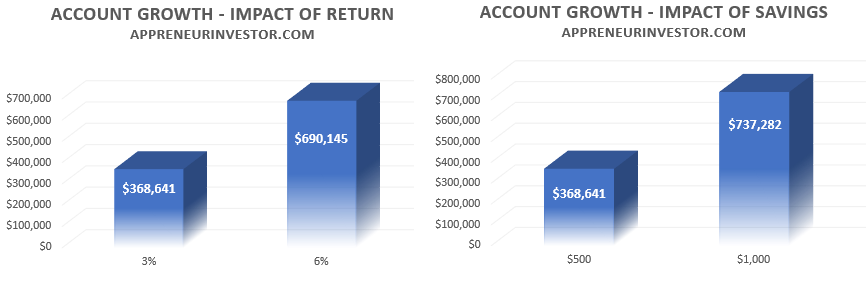

Alternatively, putting more money to work can have a greater impact on your future retirement income than a higher rate of return. Have a look at the two charts below. On the left you can see the impact in a 100% increase in the rate of return versus a 100% increase in the savings amount.

By doubling the amount saved every month, the amount available after 35 years is $47,137 higher. That may not seem like much, but in retirement it can make all the difference.

So you should invest as much money as you can into your 401k. But what if you already have contributed the maximum amount to a 401k? If you are a business owner then you can use a 401k cash balance plan combo to increase your savings rate.

What is a 401k Cash Balance Plan Combo?

If you have been fortunate enough to contribute the maximum amount to a 401k, a cash balance plan is another tool you can use to increase your savings. In 2017, the IRS caps you off at $54,000 across all of your defined contribution retirement accounts.

However you can exceed the $54,000 maximum by having a cash balance plan in addition to your 401k.

A cash balance plan is a type of defined benefit plan that is set up by your company. The company contributes to the cash balance plan on your behalf. An investment manager then invests that money for you (you cannot manage a 401k cash balance plan as a do-it-yourself investor). You then receive a statement each year with the hypothetical value of the account that you are eligible to receive at retirement.

How much that gets contributed into your 401k cash balance plan is based on two factors. The first factor is a set interest rate, usually around 5% or a rate tied to the U.S. 30-year Treasury bond rate. The second factor is a percentage of your salary. The combination of these two factors are put into the account and saved for you until retirement. Here is a great example of someone who is 45 years old with a 401K cash balance plan.

$18,000 (401K) + $36,000 (Profit Sharing) + $133,100 (Cash Balance) = $187,100 (Total Tax Deferred Savings)

Benefits of a 401k Cash Balance Plan Combo

The obvious benefit of a 401k cash balance plan is it allows you to contribute a lot more money to a retirement account. The more money you contribute, the more money you have at retirement. There are a couple of other key benefits that you need to be aware of.

#1 Almost Guaranteed Rate of Return

Since contributions are paid to the plan by your employer (or company you own) based on a set interest rate and a percentage of your salary, you will see guaranteed growth in the account. You do not contribute any of your own salary to the account.

#2 You Don’t Need to Manage the Investments in the Plan

Just like a defined benefit pension plan, a 401k cash balance plan must be managed by an investment management company. That means that all investment decisions are made by them. You do not need to worry about any of the investment management.

#3 401k Cash Balance Plans are Portable

If you leave your company, then a 401k cash balance plan balance can go with you. The balance is typically converted to an IRA. As with all IRAs, you will then be able to begin withdrawing money at age 59 1/2.

#4 Partially Insured by the Pension Benefit Guarantee Corporation

If for some reason your company runs into trouble, a 401k cash balance plan is partially insured. The Pension Benefit Guarantee Corporation underwrites a portion of the account. Therefore, you do not risk losing the full value of the account. This coverage is complicated and will not be covered in this article. However, if you are looking to set one up, make sure you research this area more.

#5 Contributions Have Tax Advantages

If you are a company owner, then contributions into the plan are tax deferred. As an employee with a 401k cash balance plan, the contributions are tax deductible as part of the tax return process. Either way, these accounts can save you thousands in potential taxes.

Disadvantages of 401k Cash Balance Plan Combos

#1 Only for Business Owners/Partners or Employees of Company with the Plans

Cash balance plans are not a good fit for all types of companies. Companies need to be consistently profitable in order to be able to continuously fund the plans. The best candidates for these types of accounts are professional firms like doctors, lawyers, dentists, or accountants. If your company does not fit this criteria, then the government may not allow you to set one up.

#2 Must Get Approval to Set up a 401k Cash Balance Plan Combo

In order to set up a 401k cash balance plan your company must pass a few tests to make sure it is fair and does not disadvantage employees. This is usually not an issue, but must be managed appropriately during the life of the plan.

#3 Plan Fees Add Up

Each year, your company must have an actuary certify that the plan has the funds available for the participants. This can range from $5000 in set up fees to annual fees of $10,000 to cover administration and paperwork for the plan. In addition, there will be investment management fees paid to the company managing the investments. These can range from 0.25% to 1.0% of assets.

Summary

No matter how much you try, you cannot control the investment return you get from your portfolio. You are going to get what the market gives you. However, what you can control is how much you contribute. In other words, you can control your savings rate.

If you are in a situation where you are able to maximize your existing 401k, then an additional option is a 401k cash balance plan. These plans allow your company to contribute to your retirement on your behalf, providing a set amount of money that will be available to you at retirement.

They are definitely worth checking out as an option to increase your retirement account balance.

Do you have a 401k cash balance combo account? Has it been good for you? Is there anything else I should be aware of that you found while being a part of the plan? If so, please let us know in the comment section below.