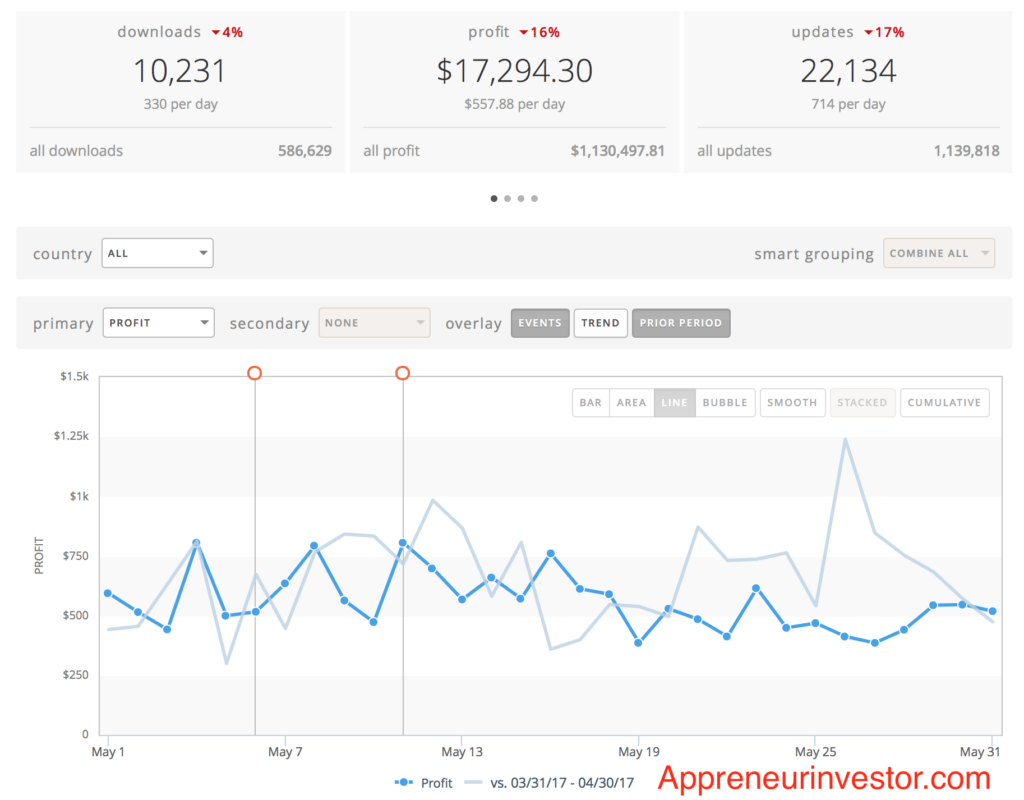

May 2017 Passive Income Apps Report $17,294.30

Our official third passive income apps report! Going to be honest. This month has been pretty uneventful, but that is a good thing. Took some time off to both recharge from our last vacation and to dip into some other new projects/ventures. For the most part, it has been running completely on autopilot. Development costs this month is under $100 from minimal maintenance. VA cost from Upwork is consistently low since our VA works consistent hours.

Our official third passive income apps report! Going to be honest. This month has been pretty uneventful, but that is a good thing. Took some time off to both recharge from our last vacation and to dip into some other new projects/ventures. For the most part, it has been running completely on autopilot. Development costs this month is under $100 from minimal maintenance. VA cost from Upwork is consistently low since our VA works consistent hours.

Vs Previous Month of April

You can see the overall passive income apps revenue stabled off a little lower towards the end of May vs the end of April. Appfigures is nice because they let you compare months with that “prior period” button. This is completely unsponsored, but I really enjoy using Appfigures and have been doing so for years. AppAnnie is the competing “free” platform which I also use. “Free” because they offer paid services to see analytics of the app store and use your imported analytics for their overall data that they sell to clients.

As mentioned in the last financial report, we released a new app at the beginning of this Month based on the subscription model. It was lucky enough to climb a decent amount. However, there were only 3 annual subscriptions and 1 monthly subscription. It’s nice since each subscription gives a steady monthly amount of income, but it’s a little more difficult to get users to switch to a subscription model. The subscription model allows us developers to be more active and frequent in our development cycles and bring better products.

Plans For June

Some exciting ventures I’m working on for June are actually completely unrelated to the passive income apps stream, but will increase monthly passive income through real estate. I’ve spent this month speaking with some out of state real estate investors. They are also known as turn-key providers. The term “turn-key” has been given a slightly bad rep in the real estate industry, but there is a lot of good business to be done in this area. I noticed on Biggerpockets.com that most people argue against the turnkey route due to being able to do everything themselves…which is fine. Nothing wrong with the following that they all are proud of doing.

- Doing the rehab myself

- Managing property myself

- Finding undervalued properties myself

Sure, there are a lot of investors that can do this, but I like to take the entrepreneur route. I’ve never been afraid of delegating and getting smarter people to help me in areas I’m still new to. I’m more into creating a system that purchasing 1 product/property. This is what has attracted me to turn-key rental properties for investment.

This quote I heard this month really resonated with me. It inspired me to dabble into other areas and put in my due diligence and learn something new.

[clickToTweet tweet=”Every 5 years, you get another 10,000 hours” quote=”Every 5 years, you get another 10,000 hours”]