In a recent post I did a comparison of the top robo advisors and two of the top options included Personal Capital and Betterment. This article is going to conduct an analysis: Personal Capital vs Betterment. In the end you will get a good picture of which advisor will be the best for you.

Personal Capital Overview

Personal Capital is one of the largest robo advisors available to retail investors. Over 1.3 million users use Personal Capital’s financial software and free tools to track their personal finances. Even more impressive, the company has over $4.2 billion assets under management.

Personal Capital is one of the largest robo advisors available to retail investors. Over 1.3 million users use Personal Capital’s financial software and free tools to track their personal finances. Even more impressive, the company has over $4.2 billion assets under management.

That huge customer base is a result of an impressive approach to financial management. The company has built a solid suite of tools to keep track of your money, as well as their robo advisor approach. It is this approach that sets the company apart from competitors, including Betterment.

Called Wealth Management, the robo advisor service builds a portfolio for you based on your investment goals but also gives you access to a registered advisor who can provide you with personalized advice. This is offered for a fraction of the cost of traditional investment management firms (more on that later). The service’s algorithms as well as the personalized investment advice will give you the exact portfolio required based on your goals.

Betterment Overview

Betterment is one of the original robo advisors. Whereas Personal Capital takes a more holistic approach to managing your finances, Betterment is more focused on just your investments.

With that focus, they target their services to individuals looking to make saving for retirement easy. Through the extensive questionnaire when you open an account, they get a view of your time horizon and risk profile. That information creates a diversified portfolio with the appropriate balance between equities and fixed income. Over the years re-balancing occurs as well as tax loss harvesting to help boost returns.

Overall, Betterment provides a good investment robo advisor, but is not as complete as Personal Capital with all the wealth management tools.

Personal Capital vs Betterment: Comparison

Both services are viable alternatives if you are looking for help with fully automating your investments. However, as already discussed there are some key differences. Let’s have a look at those differences to help you decide which one is better for you.

Key Service Differences

There are two key differences when pitting Personal Capital vs Betterment. As a potential client, these are critical to understand. Depending on your needs, the differences will determine which company is better for you.

Personal Advisor

As discussed, Personal Capital provides access to an investment advisor to help build your plan. Both companies offer all the services of a robo advisor, including automated portfolio building and management. The difference is that Personal Capital also provides you with personalized service to deal with specific situations you may need clarification or tailoring on with respect to your portfolio.

For example, if you have specific tax requirements due to your employment situation, the investment advisor may be able to help you with selecting a better mix of funds. This additional assistance can be very valuable if it improves your returns and/or saves you tax.

Holistic Wealth Management

The other key difference between Betterment and Personal Capital is the wealth management approach. Betterment focuses its service on managing your investment account. That may be all you need, but Personal Capital has bundled other services that may add additional value to you.

Personal Capital has decided to focus on overall wealth management and personal finance. They combine investments with tools to support overall net worth growth, cash flow, spending, and budgeting. Their view is that to properly growth your overall wealth, you need to focus on all the important personal finance aspects. This helps manage cash flow, maximize contributions, and potentially improve your income at retirement.

Performance Comparison

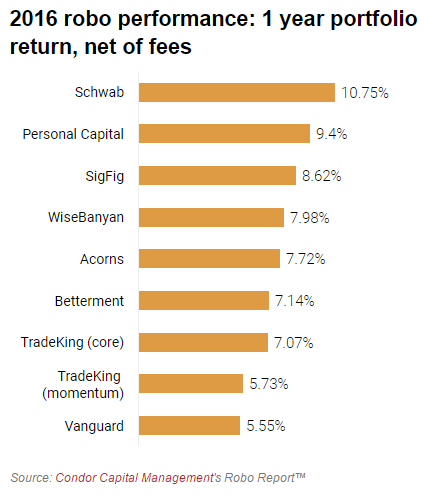

At the end of the day, robo advisors are only as good as the returns the portfolio generate. If they are not able to at least meet the returns of the overall market, then you could be better off just investing on your own in something like a three fund portfolio.

Here is how the major robo advisors performed in 2016. As you can see there is some pretty big differences in returns.

From a straight up return perspective, Personal Capital’s investment approach proved to be a better option in 2016. Their portfolio produced a 9.4% return, compared to Betterment’s 7.07% return.

Comparison of Fees

Next to investment performance, fees are the next most important factor when pitting Personal Capital vs Betterment. In this respect, Betterment has the edge over Personal Capital. We can assume that the the additional fees for Personal Capital accounts is due to the personal advisor you receive. You need to make the call if having access to that advisor is worth the extra fees.

Keep in mind that even with higher fees, Personal Capital still beat Betterment in 2016 performance (see chart above).

Here is the Personal Capital vs Betterment from a fees perspective:

- Personal Capital:0.49% to 0.89% of account balance

- Betterment: 0.25% to 0.5% of account balance

Again, you need to make the call if the performance history and access to a personal advisor is worth the extra fees.

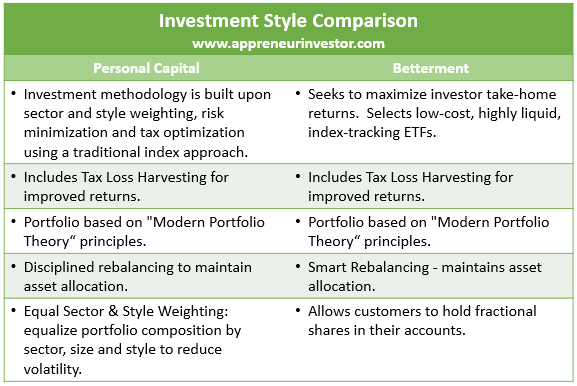

Investment Style Comparison

Overall, robo advisors offer similar asset allocations. However, there are some minor differences that are important to consider. For example, Personal Capital provides equal sector and style weighting, which strives to reduce volatility by equalizing across sectors, company size, and style. For investors worried about good returns with limited volatility, this is an important factor.

Here is a summary of the different investment styles of the two services:

Which Robo Advisor to Choose?

Deciding which robo advisor to choose is a tough decision. There are a number of factors to consider. Hopefully this post provides you with information that will help you with that decision.

Personally, I am a bigger fan of Personal Capital due to the personal advisor service as well as the solid performance last year. It is interesting that with such similar investing styles, there are such differences in investment performance. However, with the solid 2016 performance, it seems that Personal Capital is doing things just a little bit better.

Have you looked into both Personal Capital and Betterment and decided to go with either one? Let us know in the comment section below?

Very helpful article! Looks like Schwab outperformed them both. Would you like to comment on using Schwab versus Personal Capital?